In the last post, we learned about how England first developed central banks and bank notes. But how did this come about in America? At least in part, war was responsible…

Some of the founding fathers didn’t want central banking

While England went forward with its implementation of a central bank, many of America’s founding fathers saw central banking as a bad thing. They felt that England controlling the monetary supply of the colonies was oppressive and viewed this as a direct cause of the American Revolutionary War.

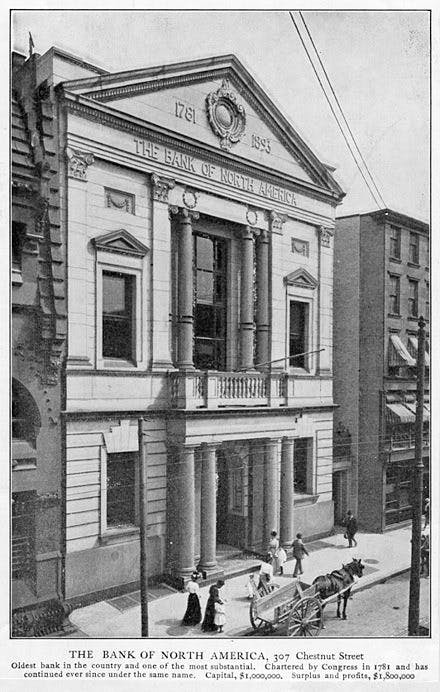

Meanwhile, others, like the superintendent of finance, Robert Morris, were in support of a central bank. So Morris made it happen. In 1783, the Bank of North America was established, becoming the first commercial bank in the United States.

However, the bank didn’t quite work out because it was said to have “alarming foreign influence and fictitious credit.” Moreover, it was overtly corrupt and tried to implement unfair policies against state banks issuing their bank notes. As a result, the bank’s charter was eventually repealed.

First Bank of the United States

In spite of the difficulties, Robert Morris was not giving up. Through some clever agreements, he got Congress to charter the First Bank of the United States in 1791, and soon after, George Washington signed off on it.

The First Bank of the United States was modeled after the Bank of England, which had impressed Alexander Hamilton. He believed it did a good job serving as the central bank for the growing British Empire.

However, unlike the Bank of England, the First Bank of the United States was not solely responsible for the country’s supply of bank notes. Rather, it was responsible for only 20% of the currency supply while state banks printed the rest.

Founding fathers like Thomas Jefferson were not fond of the idea of a central bank. They felt that the bank could be used for speculation, financial manipulation, and corruption. Twenty years later, in 1811, the First Bank’s charter expired and was not renewed by Congress.

This happened at the same time that the War of 1812 was being waged. With the national bank closing, the government suddenly struggled to fund the conflict. (PS: One big reason governments want a central bank is because it makes it easier for them to print money and fund wars.)

But since the First Bank had ended operations, the only way to fund the war was for the federal government to issue treasury notes. Treasury notes were short-term debt instruments that served as credit to fund the war.

Second Bank of the United States

Five years after the First Bank shut its doors, plagued by inflation, the government decided to launch the Second Bank of the United States in 1816 to try and curtail the issue. The Second Bank was basically a copy of the First Bank.

Andrew Jackson, who became president in 1828, denounced the bank as an “engine of corruption.” He set out to destroy the bank, which caused major political issues in the 1830s. Jackson portrayed the bank as a tool of the special interests at the expense of “regular” people. In fact, this is what led to the second party system (Democrats opposed banks and Whigs supported them).

When Jackson was unable to get the bank dissolved, he refused to renew its charter. In an effort to make the bank obsolete, he also decided to create an executive order requiring all federal land payments to be made in gold or silver.

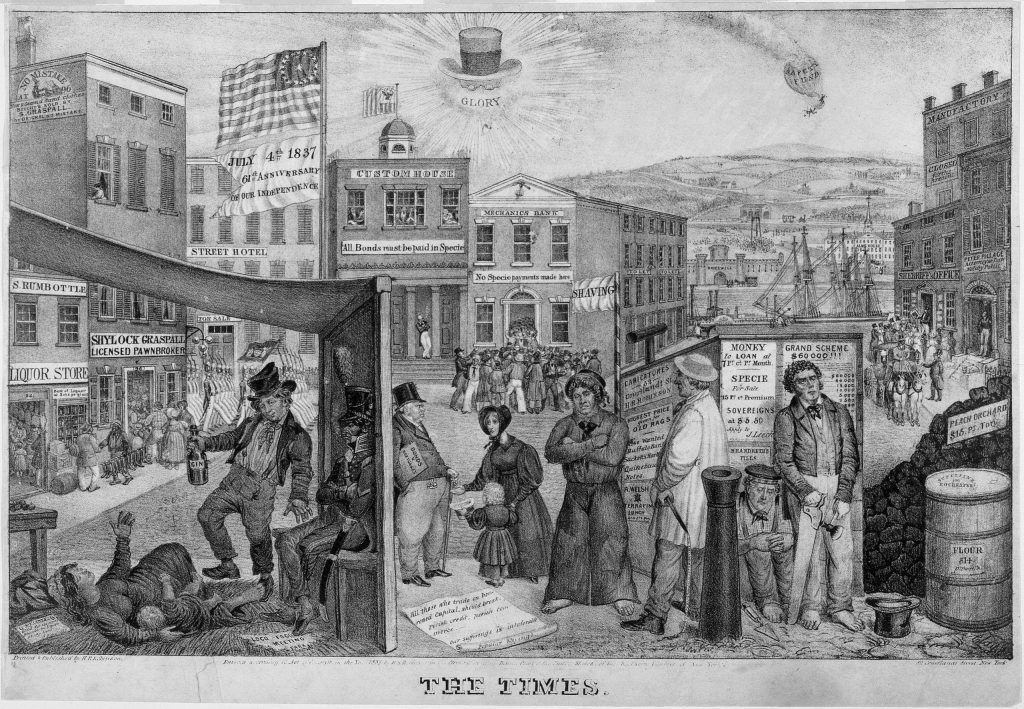

This was one of the major contributing factors to the Panic of 1837, and the Whigs blamed Andrew Jackson for it.

The Panic of 1837 was the first of many panics in the USA (as we’ll learn in future posts). Those of you reading this may or may not have lived through a financial panic. If you did, you may have been too young to understand what was going on. So let’s take a minute to understand what a panic is.

What causes panics?

Financial panics happen when people suddenly lose confidence in one or more banks and no longer feel comfortable depositing their money in that bank.

Let’s take a look at an example:

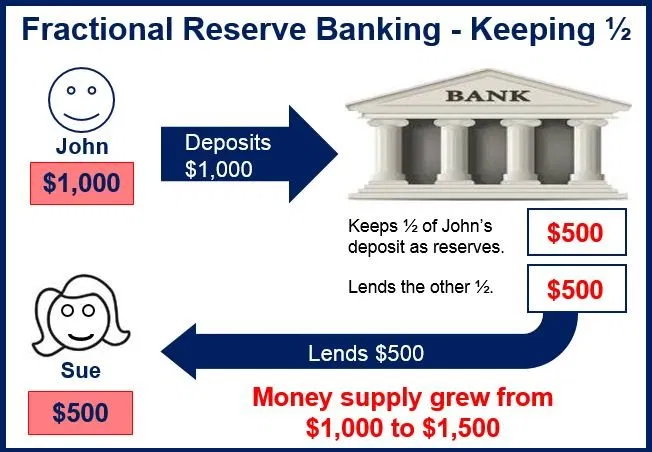

Imagine there is a bank. This bank, like all banks, finances itself by taking deposits from ordinary people and paying them a tiny interest payment on their deposits. Then the bank turns around and uses those deposits to make loans to consumers.

Now, imagine that a rumor goes around that this bank is giving out loans to people who have a high risk of defaulting on their loans. The depositors who deposited their money with this bank hear the rumor, and they start to question the bank’s ability to recoup its loans. So what do they do? They pull their deposits out of the bank. One by one, depositors line up and try to get their cash.

But remember that banks don’t just take your cash and hold onto it. No bank holds all the cash of its depositors.

Instead, they hold onto a portion of the cash deposited (e.g. 50%) and lend out the rest as loans. Banks earn interest on these loans, and that is how they generate money as a business.

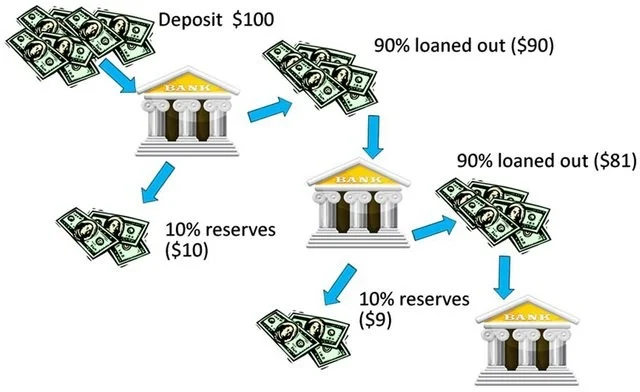

In reality, most modern banks only keep 10% in reserves, and lend out the rest to other banks or people:

This system is known as a “fractional reserve system”. Can you see how a fractional reserve system could be an issue if there is a financial panic?

When there is a panic, suddenly the bank has too many people knocking on its doors (known as run on the bank), wanting to get back the money they have deposited. But remember that a lot of the money is not sitting there idle. It’s already been lent out to borrowers. So the only way the bank can give the depositors their cash (after it goes through its reserves) is to sell the loans. It takes time to do this, and so the bank ends up having a liquidity crisis and failing.

Once one bank fails, consumers get even more worried and start to lose confidence in other banks as well. This ends up creating a negative spiral and causes all sorts of problems, including:

- Widespread bank runs

- Restrictions on depositors’ access to their funds

- Bank failures

- Stock market crashes

- Economic contractions.

In short, banking panics are a bad thing. We want to avoid them as much as possible.

This is exactly what happened during the Panic of 1837 after the Second Bank of the United States failed. The panic led to a major depression and a lot of pessimism in the USA. Banks collapsed, businesses failed, prices declined, and unemployment soared.

Conclusion

So, we’ve looked at some colossal failures in the early United States’ attempts at banking – the Bank of North America in 1782, the First Bank of the United States in 1791, and the Second Bank of the United States in 1816. But eventually, the country did figure it out and moved onto the next era in finance…the free bank era, which we’ll learn about in the Part 2.

Add Comment