I will show you two graphs, they will change your life forever.

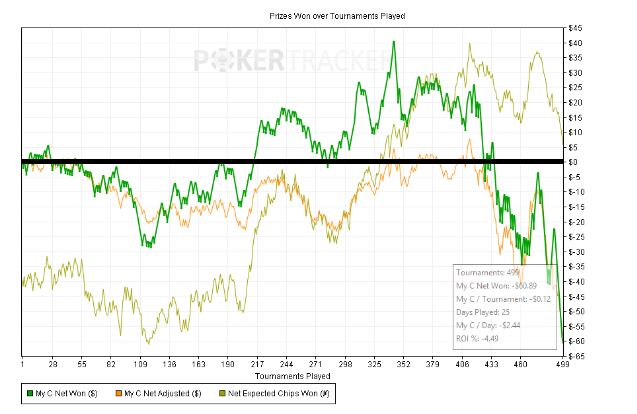

For those of you who played poker a lot, studied it, you probably recognize this graph.

I found it on the internet, some professional played poker and showed it. But do not stress, I made a new one similar for you! So let’s start from the beginning.

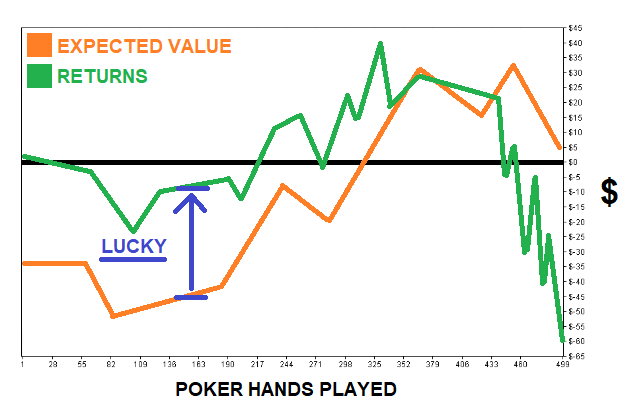

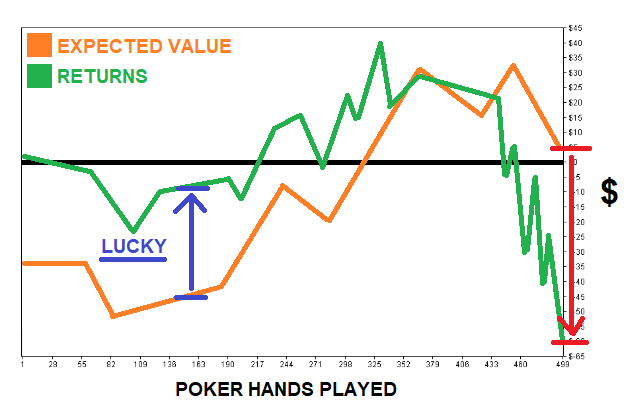

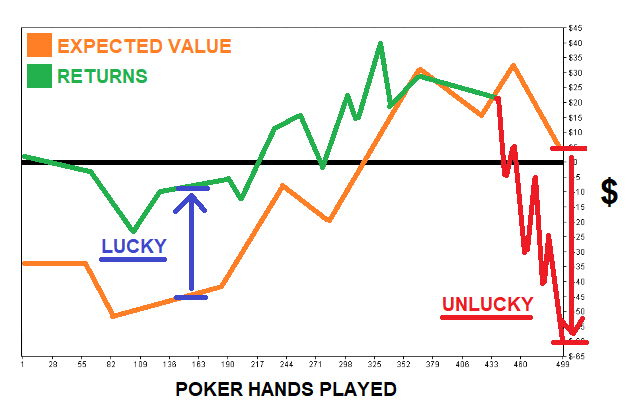

The down X axis, is representing the number of poker hands that poker player actually plays. On the right axis, you have the amount of money a poker player has made. So you have hands played, and money won.

What I have figured out, is that you can think of each poker hand like investment. In life as in crypto, you have many potential investment opportunities, and you can think about them same as poker players think of each hand that they are playing.

This line in the middle is at the level of zero dollars, or zero ROI. In the worse case you can go below 0 dollars – you can lose money, in better case you go above 0 dollars, you make money.

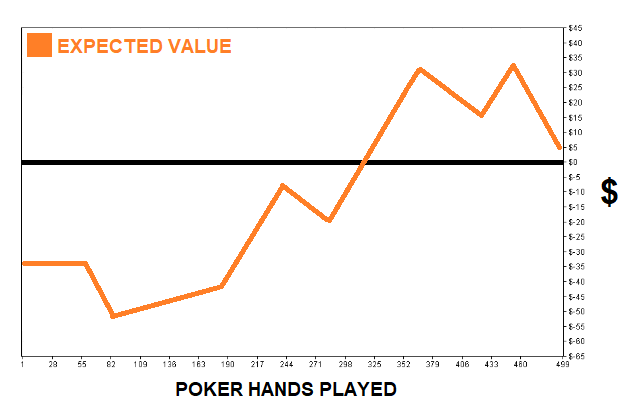

If we look at history of the average poker player, what we find is that they have, for every hand that they are playing, an expected value. Every time that you have opportunity in which you can invest, you multiply the amount of money you can invest with the probability of that investment working out. With crypto investments, overall probability is that you will lose the money. Majority is pure scam, but even if it is not scam per se, probability is almost 100% that all your money invested in cryptocurrency will be gone. I have talked about various scams in the previous video in details. Very few projects have probability that they will return some gains, and vast majority of them are being built as protocol layer.

When you look at poker, each of these little lines, each of these peaks and valleys are opportunities and expected values, above or below zero.

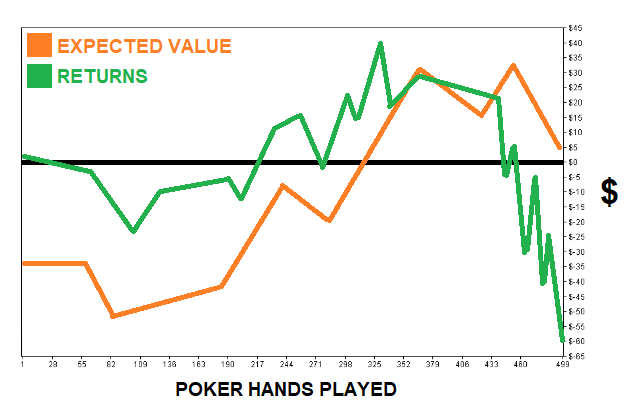

Those are your expected returns, and then when we look at actual returns… you will notice that sometimes player is making more than the expected value, and sometimes the player is making less than the expected value.

If player is making more than the expected value, or investor’s portfolio is doing better… that is this blue line right here… it means that you are lucky.

If player or investor is doing worse than the expected value, you see this big red line, that means that player or investor in our case is unlucky.

Let’s make the whole unlucky part red, right here where returns disconnected from expected value.

Now that you understand that somewhere out there is expected value, where if you make a bet you can either go towards that expected value to the up or down, and if you understand the probability, meaning that you will make more bets only when current situation is way under the expected value with good odds of achieving it… even if you do everything perfectly, you will not always going to perform as expected.

This poker example is not about gambling or trading, although it can be. Technical analysis works just like poker: you identify situations where you have an edge, place bets accordingly, win some of the time and lose some of the time. That’s it. And this is true. Trading is about setups, profit taking and stop-losses. However, keep on mind that this is not investing – it’s trading – be aware of the difference.

Luck is always needed!

This is where the luck comes in. You need to understand that luck is always part of the game, the part of life, the part of everything that you are doing. Always… Luck is meaningful part of being an investor. You have to understand that no matter how good you determined the expected value, there is some chance that investment will go wrong and fail.

It is like “Got talent” or “The Voice” show. You absolutely can not guarantee that finalist or winner of the season will actually become a star. Yes they have a great potential, stars are aligned for them to become a stars, they are the best of the rest, but that is simply not enough. Metaphorically, your job is to identify them in the first round of the show and bet on them, because they have the best chance to win at the end of the season of the show, and become a star. But they still need some luck to gain traction outside the show and become a real stars.

Managing risk

Some people are saying that you should diversify, because you can never know what is going to work and what is not going to work.

I disagree strongly. I think that diversification is strategy for people who has weak opinions. They do not know how to determine the actual expected value, and the reason is they do not understand what they are doing, and they have simply not experienced how the success looks like.

As Druckenmiller says: “I like to have all my eggs in one basket, then keep my eyes on the basket.”

Diversification is overrated in wealth creation in my experience. You use winners to pay for losers.

Here is what I am suggesting instead: Do it the way you would buy condo for rent to someone else. You would need to know absolutely that 20 years from now it will be costing way more than you bought for. In real estate, that certainty comes from location. Location of this condo is competitive advantage. The location development is giving you the certainty that 20 years from now it will be worth more than it is today, and that gives you confidence to make that investment with all of your money.

People do not worry about diversifying when they are buying something that they understand.

So first you need to understand everything there is in this new cryptocurrency asset class you are considering. And let the invested money to compound over time. Albert Einstein said that compounding is the biggest force in the universe.

Here is now something from my cheat sheet, one idea that will help you to not diversify:

After you have done your own research on various cryptocurrencies, pick the cryptocurrency of the ecosystem that you like and that you use yourself. It is astonishing how many people think that they can make money from the thing that they do not even like, but same thing will someone somehow going to like it, buy it and use it. Own the cryptocurrencies with which you are tying your personal values with the values of what that cryptocurrency represents.

Winning odds

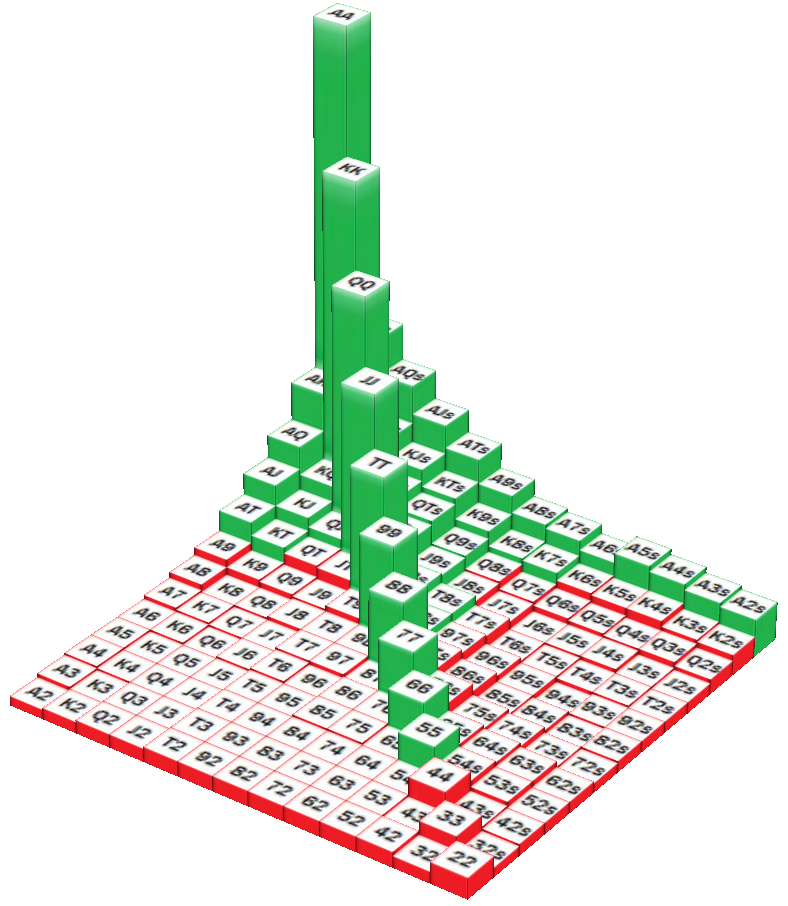

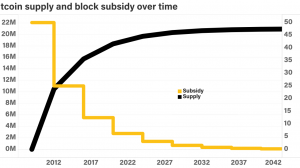

I will now introduce the next chart which represent the implied odds of the win – based on your starting hand. The simple way of thinking about this “Eiffel pyramid of gains” – crazy name right, I just named it that way, ha!

It has two letters, or a letter and a number which represent the specific card, and these are the starting cards in the poker game.

If we would apply this on cryptocurrency, the first card would represent the design of the cryptocurrency – is it a protocol, an app, nonsense coin. The next is whitepaper, then the competence and experience of founders, and so on.

To not get you confused, the point of this metaphor to illustrate the point that most of these are red as you can see. Most of these starting pairs are really crappy. The bad cryptocurrency investments from the beginning, because they do not make sense. As a poker player, you do not want to continue playing with most of the hands because look how many of them are really awful. They are really terrible. The expected value is bad.

But!

You can see that couple of these green ones are starting to look little better, and in the center, way up you have a huge tower, two AS’s. If you are starting the poker game with two AS’s, it is way way above average chances of winning in comparison to all these garbage laying around… which is a really good metaphor for what we have in the crypto space. Most cryptocurrencies that you see is garbage (even in top 100!), and if you are diversifying, sprinkling your money around, chances are that you will sprinkle it on garbage, and it is a very slim chance that you will sprinkle it on good stuff with awesome upside.

“Remember, you need to pick just one big winner in order to make huge return.”

Here is why: Let’s go back in the dot com boom. What would be the chance that you will pick only the winners, like Google, Amazon, Netflix, Apple, eBay, Paypal? Now think about what are the chances that you will pick only Google, or only Amazon, or only PayPal?

Well, because it is really hard to DYOR (Do Your Own Research) and really put the time effort and know-how in getting familiar with some cryptocurrency, it is way bigger chance that if you go with only 1 choice, it will turn out that you picked the one with the highest potential. It does not matter if there are 5 or 10 similarly good, because it is not humanly possible to figure out in great details AND keep eye on 10 different cryptocurrencies At best you can do with few, but I suggest you to do with only 1.

Then, after you feel comfortable with that 1, you have skin in the game, I mean skin in the chain in that 1, start comparing that 1 with some other cryptocurrency, and if it after short period of time comes even close to the 1 that you already have chosen, start digging deeper, and who knows, maybe you will sell the old to buy the new one. Or you will start investing in 2nd as well.

There are very few cryptocurrency worthy looking at, and this is why picking one of these very few, making educated guess on it is completely opposite of what most people are doing in the crypto space.

Slow and steady wins the race

People are putting money into things on a hourly, daily, weekly basis. People are impatient. They want results right now. They want their bank accounts to explode overnight, basically to get rich quick. And they are treating the cryptocurrencies as gamble or get rich quick scheme.

If that’s your mentality, the likelihood of getting rich by investing into cryptocurrencies is going to be very unlikely.

What will be likely is that you will LOOSE all your money, or some of your money by playing on the crypto markets with other traders. But if you can exercise patience and very carefully select the projects that you’re going to be involved with, your chances of hitting on something excitingly good are going to be much higher.

I am searching for cryptocurrency which has insanely high expected value. And guess what, they are very rare, as it should be. Where will you find them?

I will tell you where you will NOT find them. You should not look for these on Twitter, you should not look for these on Youtube, You should not look at these on Telegram groups, you should not look for these on Reddit, you should not look for these anywhere, because you should not trust anybody in the crypto space. Heck, do not trust even me, use your own brain, and DYOR (Do Your Own Research) so that you can Bring Your Own Conclusions!

You have to know how the asset (in this case cryptocurrency) you invested in work. If you do not go into the rabbit hole with cryptocurrency, do not even bother, because it is hard and a lot of people in the crypto space are yelling and screaming to buy these little red tiles of the “Eiffel pyramid of gains” that are growing in price (note: price, not value – price is not equal value!), assuring you that they are this unique gigantic green tiles, because they just want to make money, by taking your money.

When and How to diversify

Let’s see when diversification is good. We concluded that wealth is created through concentration of assets. The opposite is true for saving or keeping your wealth safe and secure. Wealth is preserved through diversification.

“So diversification is for preserving wealth, concentration is for building wealth.”

Ok great, so if you want to create wealth you need to have 1 risky cryptocurrency, and few safe cryptocurrencies, right?

WRONG!!!

There are no such thing as safe cryptocurrency, or risky cryptocurrency! Risk is coming from not knowing what you are doing.

If you don’t know how to drive a car, driving any car is risky, and it is not less risky if you are trying to drive the car on the middle of the road… because statistically speaking, there is lower chance that you will get off the road and crush the car, or that you will hit a man on the street, or that you will hit another car on the road because there is more space for avoiding cars in both direction.

Diversification is effective among asset classes. That is especially true for crypto space, where if bitcoin drops, every cryptocurrency drops even more.

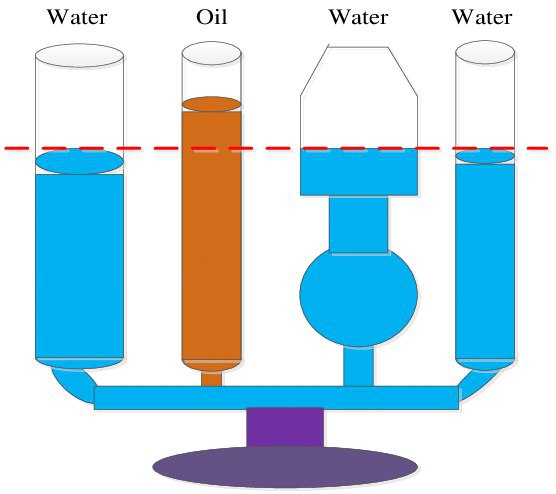

Markets are communicating vessels. What happens to one, impacts the others. If one market drops, is because people are leaving it, unless they hold the cash which is not good for preserving wealth, they are migrating their assets to the other market, other asset class.

Here is the illustration that will help you understand this. If you put pressure on one side, it will have impact on the other side.

So if you want to preserve wealth you need to diversify, and you need then to have few stocks, few cryptocurrencies, few precious metals, few real estate properties because these are all different asset classes.

You are more diversified if you have 1 cryptocurrency and few assets in other asset classes than if you have 30 cryptocurrencies.

You can have portfolio for wealth growth, and for wealth preservation.

How much would you allocate of your wealth to which portfolio, is up to you. If you have net worth of $100 million, it would be not smart to put majority for wealth growth, especially in aggressive wealth growth such as cryptocurrencies. Me personally, no matter what, think that it is good and healthy to always have some cash stack for emergencies. Then to have decent bag of wealth preservation assets, and decent bag of wealth growth assets. At the end of the day it is up to you, what you want or need to achieve.

Always keep on mind that Warren Buffet did not get wealthy by diversifying his money all over around, but by carefully examining and picking assets one by one for very long term, and it turned out that it is the winning formula.

Nevertheless, diversification

That was one side of the coin, which always has two sides.

Because crypto is speculative market (unfortunately), because market is not looking at fundamentals, it’s actually beneficial to have several cryptocurrencies at the same time with high potential. Because market is highly speculative and least driven with fundamentals (which makes really long time to materialize) when it’s crypto bull market, all decent cryptocurrencies will grow fast and big, and they will certainly outperform bitcoin.

Because we can not know what will actually happen, but we can know with decent certainty that some cryptos have higher potential and upside than the rest. And one of these cryptocurrencies will catch hype faster then the others. Then when hype goes away, you can redistribute gains to other cryptocurrencies you have, which has not grown yet (or has grown just a little bit compared to this one) in current crypto bull market.

This is what VCs are calling “exit and redeploy strategy,” but you are not exiting 100% out of crypto you like (what Peter Lynch would say “never get completely out of the market”) but you are redistributing gains so rebalance the weight of your portfolio of still very few cryptocurrencies.

You can always take some money, like 1% of your portfolio to play around if you really want to, just to satisfy your urge of chasing pumps if that is the thing you like.

Keep on mind that 80% of the gain will be driven by 20% of cryptocurrencies, and with this strategy you will earn a lot of money if you are in the market at the begging of the crypto bull market cycle. But even if you do not want or like to follow the crypto market and trade cycles like this, and you just want to buy and forget, that will also bring results because of what is called “tail events,” but then you would need much more picks, or much better picks.

The man called Heinz Berggruen used this strategy to make wealth over the really long term.

Tail events

Heinz Berggruen, a man who fled Nazi Germany and settled in America, became one of the most successful art dealers of all time. He collected a massive amount of art, including works by famous artists like Picasso, Klee and Matisse. In 2001, he sold part of his collection for over 100 million euros on auction.

One of those picture was La Montagne Sainte-Victoire by Paul Cézanne which he sold for 38.5 million euros.

The same picture was sold for $137,790,000 (over 250% ROI) at Christie’s in New York in the year 2022… which represents the point why you should never ever exit out of awesome asset, even if it grows a lot in the price.

What was his secret to acquiring so many masterpieces? Was it skill, Was it luck?

This picture looks like any other picture, but this one turned out to be worth significantly more than others. Heinz Berggruen could absolutely not know which of the pictures, if any, will be much more valuable than others.

According to Horizon, a research firm, great art investors buy vast quantities of art and hold onto them for a long period of time. They wait for a few of those paintings to become well known and worth a lot of money, even though most of the paintings they bought were not worth very much.

In other words, it’s not about being right all the time, but having a diversified portfolio and waiting for a few winners to emerge. Perhaps 99% of the works someone like Berggruen acquired in his life turned out to be of little value. He could be wrong most of the time, but that doesn’t particularly matter if the other 1% turn out to be the work of someone like Picasso.

These events are known as long tails. When a small number of events can account for the majority of outcomes.

The long tails of Berggruen’s art collection are what led to his ultimate fortune. The story of Berggruen teaches us a valuable lesson about investing and this long tail concept also applies to many aspects of business and investing. The obvious example is Venture Capital.

Most of the startups in a VC fund will fail and lose money for the fund, but all they need are a few outlier startups which make 20x + returns to make up for losses.

Take Amazon, for instance. In 2018, it drove 6% of the return on the S&P 500 even though it is just one company. If we look inside Amazon, its growth was largely driven by two tail events: Amazon Prime and Amazon Web Services. These two products alone more than made up for all of Amazon’s less successful experiments, such as the Fire Phone or travel agencies.

After the disastrous release of the Amazon Fire phone, rather than apologizing to shareholders, Jeff Bezos said: “If you think that’s a big failure, we’re working on much bigger failures right now. I am not kidding. Some of them are going to make the Fire Phone look like a tiny little blip.”

Bezos understands that it is OK to make mistakes and fail with most products if the process creates the 1% of Tail event products that drive everything. This is similar with cryptos because they are, afterall, just experiments, our which vast majority will fail miserably.

Tail events are mostly unintuitive and hidden from us because we only see the finished products and not all the failures along the way that led to that finished product.

Let’s take for example a stand up comedian. When you are watching the Netflix special, you are probablysaying to yourself: „Wow this comedian is amazing!“ What you aren’t seeing are all the trial and error failed jokes that the comedian tried out in small clubs all around the country before doing the special. The Netflix special is the 1% compendium of all the tail event jokes that actually made people laugh. 99% of the jokes along the way were probably just OK.

When it comes to investing, even though long tails are prevalent, most of us ignore them. When things go wrong, we tend to overreact. As soon as you accept that tails drive everything in business, investing, and finance, you realize lots of things may go wrong, fail or fall apart.

Remember: Out of the nearly 500 stocks Warren Buffet has picked, only 10 have made the majority of his money. Good investors will only be right half of the time. Good leaders will only make good decisions half of the time.

So what we can expect with cryptocurrencies, the most riskiest asset class there is? That is why diversification is wise in the cryptocurrency market. But not from the aspect of gambling, which means that you have very diversified portfolio because you do not know what you are doing, but from crazy market which is gambling, and they can completely neglect the best cryptocurrencies out there for a very long time. Because there is not middle in the crypto market, it’s or doom or gloom, you should have couple of best cryptocurrencies you can find.

The fact that you (or the management behind cryptocurrency) might be wrong sometimes doesn’t mean that things won’t work out over time. In the end, the outcome can be determined by only a small number of events.

[…] If house hits 50 oz of gold as I said, that means you could buy 480 homes. Exactly the same home with which you started with in the 1920s. It’s just the same very trivial investment, just jumping from different asset classes which is the point of diversification. […]